RV Depreciation: Everything You Need to Know

Let us start with the results:

I have research RC depreciation on different types of RVs with different price ranges and I have found the following results:

-

- Buying an RV is not a good investment. It is almost the same as the cars, you will lose around 20 % instantly when you drive it off the lot. But of course, this rule is for the NEW RVs for the used ones the percentage is lower.

- In terms of depreciation, it is best to buy a 5-year-old RV and which has been very little used during this period.

- Motorhomes depreciation-related more to the rear of the RV and not so much the mileage.

- The Depreciation for Class A and Class C motorhomes is almost the same but it is a big difference between 5 wheels and travel trailer. Depreciate for the expensive 5 wheels is a little bit faster.

Depreciation on a Class A Motorhome

- One year old – it is around 20% depreciation

- Two years old – 24% depreciation

- Three years old – 26.7% depreciation

- Four years old – 30.27% depreciation

- Five years old – 35.98% depreciation

- Six years old – 39.54% depreciation

- Seven years old – 41.15% depreciation

- Eight years old – 43.16% depreciation

Video Overview: 5 Reasons I Regret Purchasing Our Class A Motorhome

Related Post: 45 RV Accessory Must-Haves for Your Travel Trailer

Depreciation on a Class C Motorhome

- One year old – it is around 21% depreciation

- Two years old – 23% depreciation

- Three years old – 26.5% depreciation

- Four years old – 28.27% depreciation

- Five years old – 36% depreciation

- Six years old – 39.54% depreciation

- Seven years old – 40% depreciation

- Eight years old – 45% depreciation

Video Overview: Buying an RV – The Pros & Cons of New vs. Used

>> You may also like The Best Generator For Travel Trailers. <<

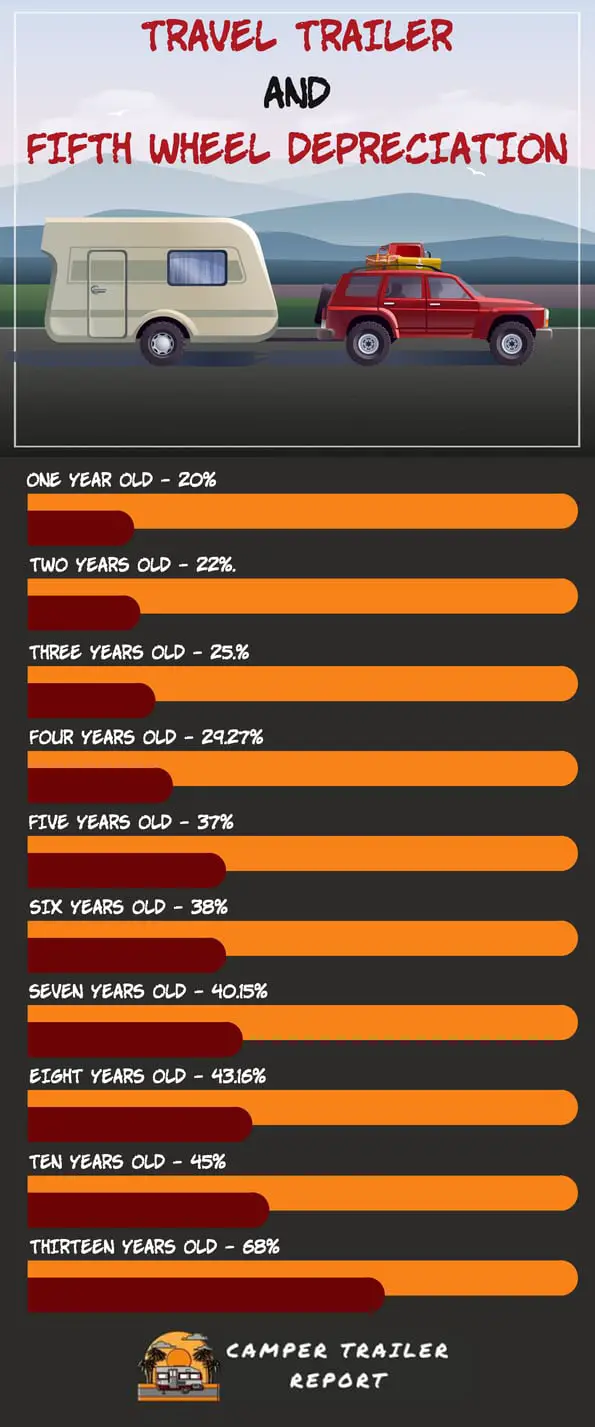

Travel Trailer And Fifth Wheel Depreciation

- One year old – it is around 21% depreciation

- Two years old – It is the same as 1 year old

- Three years old – 25% depreciation

- Four years old – 29.2% depreciation

- Five years old – 37% depreciation

- Six years old – It is almost the same as 5 years old.

- Seven years old – 38,2% depreciation

- Eight years old – 40% depreciation

Video Overview: Questions to ask yourself before buying an RV! Must watch!

RV Depreciation Curve

Regardless of the type of RV you talk about, they deteriorate. A considerable amount. Mobile homes with engines deteriorate faster due to the wear and tear of their engines.

There are preferences for buying new ones: you have the opportunity to choose the highlights that you need from the front and the center, no one else has lived in the RV, you get a guarantee from the producer and, obviously, it’s NEW!

Used RV buyers can exploit the depreciation of the unit, choose from a wider variety of models that cover a good time, reduce the cost of additional options if they are introduced, and used regularly.

RVs have low mileage. In the case of buying new or used, depreciation is something that must be obtained.

The National Association of Automotive Distributors(NADA) distributes manufacturer’s Suggested Retail Price (MSRP), low resale, and average resale costs each year for all RVs.

This gives us a quick check of the present, an incentive for a particular year, and an RV model.

In case you are buying new or used, depreciation is a real cost of ownership, almost the same as buying gas and paying camp expenses.

When you offer or change your RV, the reduction turns out to be genuine, especially in the case that you are financing your purchase.

Fortunately, not many buy RVsin MSRP.

The rebates from 20% to 30% (depending on the RV estimate) are regular: observe a portion of the larger RV dealerships. In any case, you can anticipate that your RV will be worth around half of MSRP within 6 or 7 years.

While this may scare some, you should remember that there are numerous different approaches to keeping your general living expenses at a reasonable level in contrast to a blockage and keeping the home.

This is a direction for life that can give open energy doors, and many need to understand what it takes to continue this way of life.

Depreciation is only one factor, but one that can not be overlooked. If you have the opportunity to spend two or three years or visit the nation, the complete planning of recreational vehicles can be beautiful.

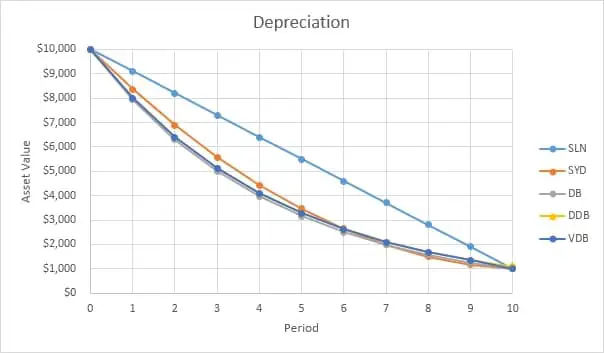

RV depreciation methods

The Internal Revenue Service (IRS) allows citizens to devalue recreational vehicles (RVs) using a straight-line strategy or an accelerated methodology. An RV is an established or long-distance resource, which means that it is a financial asset that will undoubtedly be used for more than a year. The devaluation of an RV implies extending its cost more than for a prolonged time.

Video Overview: RV Depreciation Methods

Straight line

With straight-line depreciation, the cost of an RV increases in a characterized number of periods, maintaining a similar amount of depreciation each year. For example, you buy another RV. The IRS allows a depreciation period of 5 years in the RV.

Video Overview: Calculating The True Cost of Financing a New RV

MACRS

The Modified Asset Cost Recovery System (MACRS) is a type of accelerated depreciation technique. The IRS allows owners to devalue RV. In a MACRS depreciation process, it normally allocates higher resource costs in previous years. This technique can be useful in case you should lower your evaluable in the first years after buying an RV. If you use an RV in a commercial operation, you must record the cost of depreciation in the accounting records by the end of each month or quarter.

You can also record depreciation on an annual basis. To record the cost of depreciation in an RV, load the depreciation cost record and credit the aggregate depreciation account. You must report the depreciation cost in the announcement of benefits and misfortunes. This announcement is called P & L, an explanation of salary or salary statement. Also, it will record the aggregate depreciation amounts as a decided sheet, also called articulation of the budget position or explanation of the condition related to the money.

Video Overview: Depreciation – MACRS

If you want to buy a new or used RV make sure that you check my post: Buying a travel trailer: (The Ultimate Guide)

Related Questions:

Can an RV be a tax write-off?

If you are residing in your RV, it means that the RV has distinct sections such as the kitchen, the bedroom, and the washroom facilities. That said, your RV should be a qualified tax write-off. Also, it is essential to note that it has to comply with the IRS publication 936 criteria for an RV to be a tax write-off.

Video Overview: 7 RV TAX TIPS | Deductions & Credits for RV Living

What RV has the best resale value?

Are you are looking for an RV with the best resale value? You should consider Jayco RVs. The reason is that Jayco RVs have a higher price tag than other recreational vehicles that are in a similar class.

You may also like: What is the difference between Jayco vs Fores River <<

Do motorhomes depreciate in value?

Yes, the value of motorhomes depreciates depending on how long you have used the vehicle. For instance, if you buy your RV today, the RV will depreciate by around thirty percent of the original buying price after three years. After ten years of using the RV, it will depreciate by approximately fifty percent of the original buying price.

What company makes the best RV?

The Coachmen is one of the leading brands for RV. With an experience of more than fifty years, Coachmen has been able to make approximately more than six hundred thousand units of RVs. Their goal is to produce quality and long-lasting RVs.

You may also like: 5 Best RV Brand For Full-Time Living<<

Are old RVs worth buying?

Since RVs depreciate fast, it would be advisable if you avoided purchasing old RVs. Do not be tricked into buying old RVs to save money. The truth is that an old recreational vehicle will not serve you for a long time. Therefore it is recommended you buy a new RV which will serve you for a long time.

Video Overview: 10 Rules for Buying a USED RV

What is the average lifespan of an RV?

Averagely, a new recreational vehicle will offer quality services for approximately twenty years. The lifespan of a recreational vehicle can also be in terms of the distance covered, which should be around two hundred thousand miles. However, the lifespan of recreational vehicles varies depending on various factors. These factors include how you take care of the vehicle and the class of the motorhome.

> You may also like: Why America’s Most Popular National Parks Need to Be on Your Bucket List <<